tesla tax credit 2021 colorado

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels. Purchased alternative fuel vehicle.

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

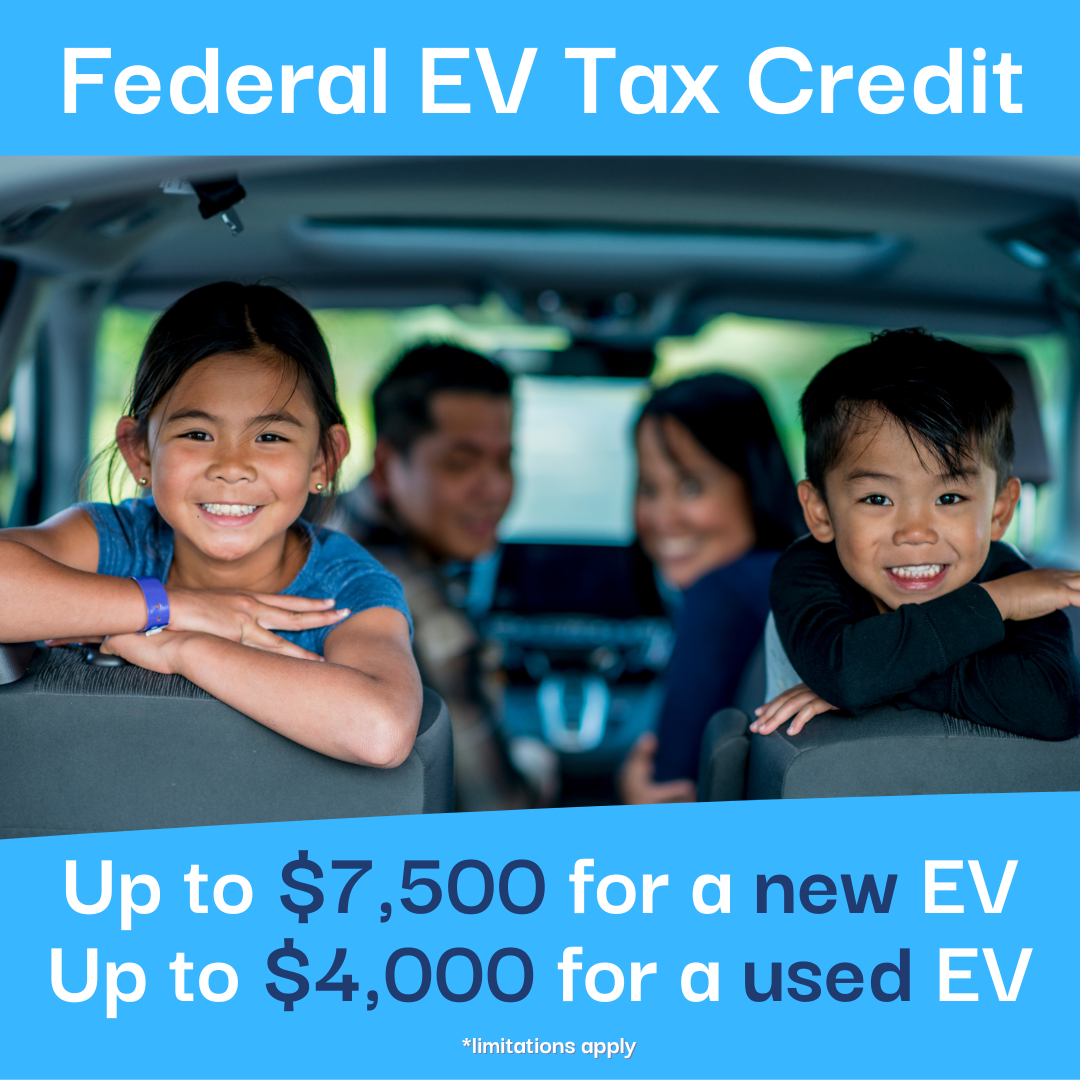

To qualify for the tax credit EVs must cost below 55000 for sedans hatchbacks and wagons and below 80000 for SUVs trucks and vans.

. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. Tesla Model 3 Performance EVs wont qualify for the tax credit while more basic trims will. Colorados credit for new EV purchases dropped to 4000 in January and will be reduced again next year.

The following states provide BEV incentives in the form of a refund for your qualifying purchase of a Tesla. Before the Inflation Reduction Act the limit on the amount of the EV charger tax credit for businesses was 30000 which still applies to projects completed before the end of. One Tesla that should qualify for the federal.

The 2021 Tax Credits Will Take Tesla To The Moon Torque News. How Much Is A Tesla. State Income Tax Credits for Innovative Fuel Vehicles.

Tax credits are as follows for vehicles purchased between. The incentive amount is equivalent to a percentage of the eligible costs. Tax Year 2021 Instructions.

You may also qualify for additional Utilities. Information on tax credits for all alternative fuel types. Be sure to use the form for the same tax.

If the stipulations in S2118 get passed this year yes the credit for a Tesla would be worth 7500 for deliveries after May 24 this year and bump up to 10000 for 2022. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. That makes only one of Teslas.

Since you asked about CO state tax the result was an entry of 5000 on line 22 of the 2017 form DR 0104 and the system added a Colorado 2017 form DR 0617 with the data. DR 0617 071321 COLORADO DEPARTMENT OF REVENUE. If filing by paper visit the Credits Subtractions Forms page to download the forms andor schedules needed to file for the credits listed below.

Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles. Innovative Motor Vehicle Credit and Innovative Truck Credit. 2500 tax incentive on ALL new EVs in Colorado in addition to the Federal tax credit available on many models.

Get information about state and federal Tax Credits and learn about how to apply these credits toward your future EV or charging infrastructure. Solar Powerwall Residential Federal Investment Tax Credit Standalone Powerwall Residential Federal Investment Tax Credit For Systems Installed In. Federal tax credits of up to 7500 are still available for most EVs.

Tesla S Dirty Little Secret Its Net Profit Doesn T Come From Selling Cars Cnn Business

Oedro Floor Mats Compatible For 2017 2022 Tesla Model 3 Unique Black Tpe All Weather Guard Includes 1st And 2nd Row Front Rear Full Set Liners Floor Mats Amazon Canada

2021 Tesla Model Y For Sale In British Columbia Applewood Auto Group

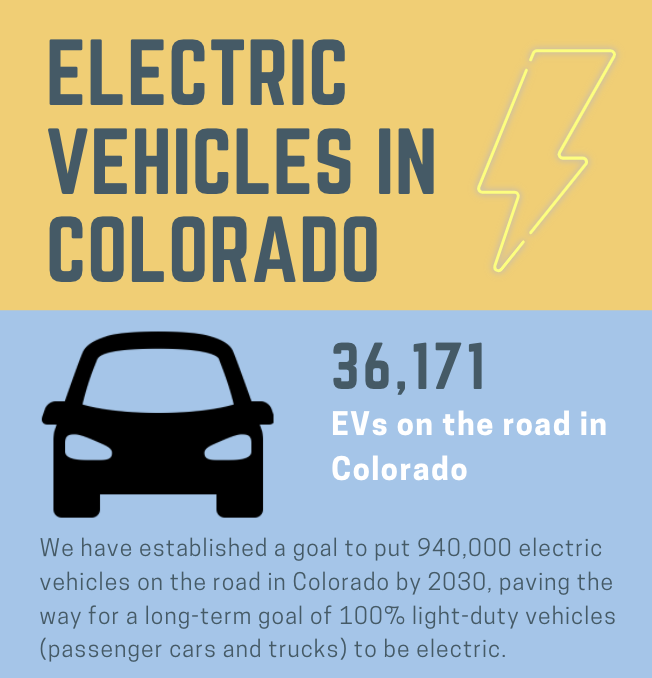

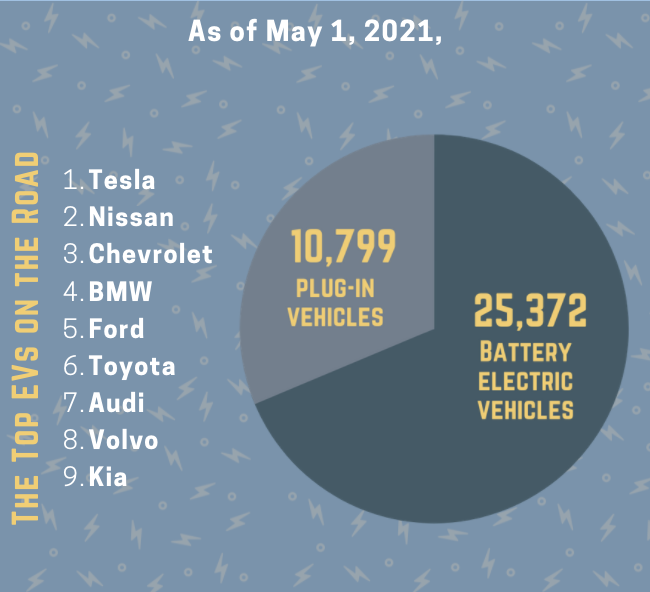

Electric Vehicles In Colorado Report May 2021

2021 Tesla Model Y For Sale In British Columbia Applewood Auto Group

Tax Credits Drive Electric Northern Colorado

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

Colorado State Federal Tax Credit Tynan S Nissan Aurora

Tax Credits De Co Drive Electric Colorado

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

Tesla For Sale In Richmond Applewood Nissan Richmond

Zero Emission Vehicle Tax Credits Colorado Energy Office

Electric Vehicles In Colorado Report May 2021

Hertz Buys 100 000 Tesla Vehicles Boosting Elon Musk Net Worth By Billions The Washington Post

Tax Credits De Co Drive Electric Colorado

How Do Electric Car Tax Credits Work Credit Karma

Compare The 2021 Gmc Canyon Vs 2021 Chevy Colorado Nyle Maxwell Gmc